Featured

Table of Contents

On the other hand, if a client needs to offer for an unique requirements child who may not have the ability to handle their own cash, a depend on can be added as a beneficiary, permitting the trustee to manage the circulations. The kind of recipient an annuity owner selects impacts what the recipient can do with their acquired annuity and how the proceeds will be strained.

Many agreements allow a partner to determine what to do with the annuity after the owner dies. A partner can transform the annuity agreement into their name, presuming all policies and rights to the first agreement and postponing immediate tax obligation consequences (Flexible premium annuities). They can gather all continuing to be settlements and any type of fatality benefits and choose recipients

When a spouse becomes the annuitant, the spouse takes control of the stream of payments. This is referred to as a spousal extension. This stipulation enables the surviving spouse to keep a tax-deferred condition and secure lasting economic security. Joint and survivor annuities likewise allow a called recipient to take control of the contract in a stream of settlements, rather than a swelling sum.

A non-spouse can just access the designated funds from the annuity proprietor's preliminary arrangement. Annuity owners can pick to mark a trust fund as their recipient.

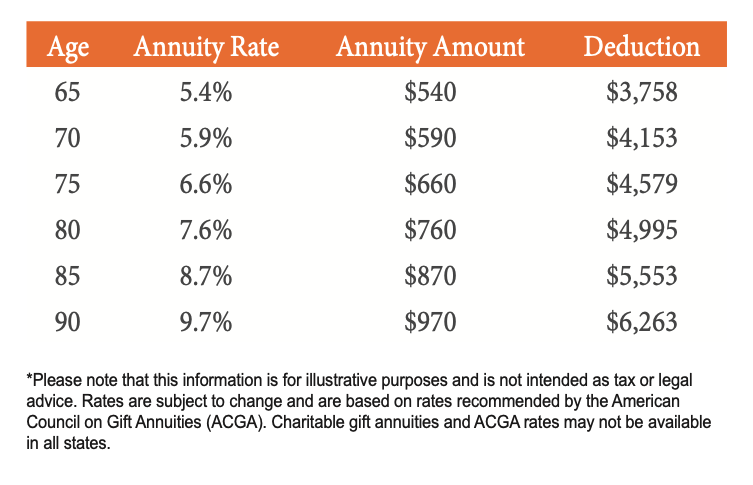

Senior Annuities

These distinctions mark which beneficiary will certainly receive the entire death benefit. If the annuity proprietor or annuitant dies and the main recipient is still alive, the main beneficiary obtains the survivor benefit. However, if the key recipient predeceases the annuity owner or annuitant, the death benefit will certainly most likely to the contingent annuitant when the owner or annuitant passes away.

The owner can change beneficiaries at any type of time, as long as the agreement does not need an irreversible recipient to be called. According to experienced contributor, Aamir M. Chalisa, "it's vital to understand the value of designating a recipient, as picking the incorrect beneficiary can have severe effects. A number of our customers choose to call their underage children as recipients, frequently as the main recipients in the lack of a partner.

Owners that are wed need to not assume their annuity automatically passes to their spouse. When picking a beneficiary, think about aspects such as your connection with the person, their age and how inheriting your annuity could impact their financial situation.

The beneficiary's relationship to the annuitant typically figures out the policies they follow. A spousal beneficiary has even more alternatives for dealing with an acquired annuity and is treated more leniently with tax than a non-spouse beneficiary, such as a youngster or other family members member. Intend the proprietor does choose to name a kid or grandchild as a recipient to their annuity

How do I apply for an Guaranteed Income Annuities?

In estate planning, a per stirpes designation specifies that, ought to your beneficiary pass away before you do, the beneficiary's offspring (kids, grandchildren, et cetera) will certainly obtain the death benefit. Connect with an annuity specialist. After you have actually selected and named your recipient or recipients, you need to continue to examine your selections a minimum of yearly.

Keeping your classifications up to date can ensure that your annuity will be dealt with according to your desires need to you pass away suddenly. An annual review, major life events can motivate annuity proprietors to take an additional look at their beneficiary choices.

What should I look for in an Senior Annuities plan?

Just like any type of monetary item, seeking the assistance of an economic expert can be valuable. A monetary organizer can assist you via annuity administration processes, including the approaches for updating your agreement's beneficiary. If no beneficiary is named, the payout of an annuity's survivor benefit goes to the estate of the annuity holder.

To make Wealthtender complimentary for readers, we generate income from advertisers, including economic specialists and companies that pay to be featured. This produces a dispute of passion when we favor their promotion over others. Read our content policy and regards to service to find out more. Wealthtender is not a customer of these financial companies.

As an author, it is among the ideal praises you can provide me. And though I actually value any one of you spending a few of your active days reviewing what I compose, clapping for my post, and/or leaving appreciation in a remark, asking me to cover a topic for you absolutely makes my day.

It's you claiming you trust me to cover a subject that is very important for you, which you're certain I would certainly do so better than what you can already find on the internet. Pretty heady things, and an obligation I don't take likely. If I'm not accustomed to the topic, I investigate it on-line and/or with get in touches with who understand even more regarding it than I do.

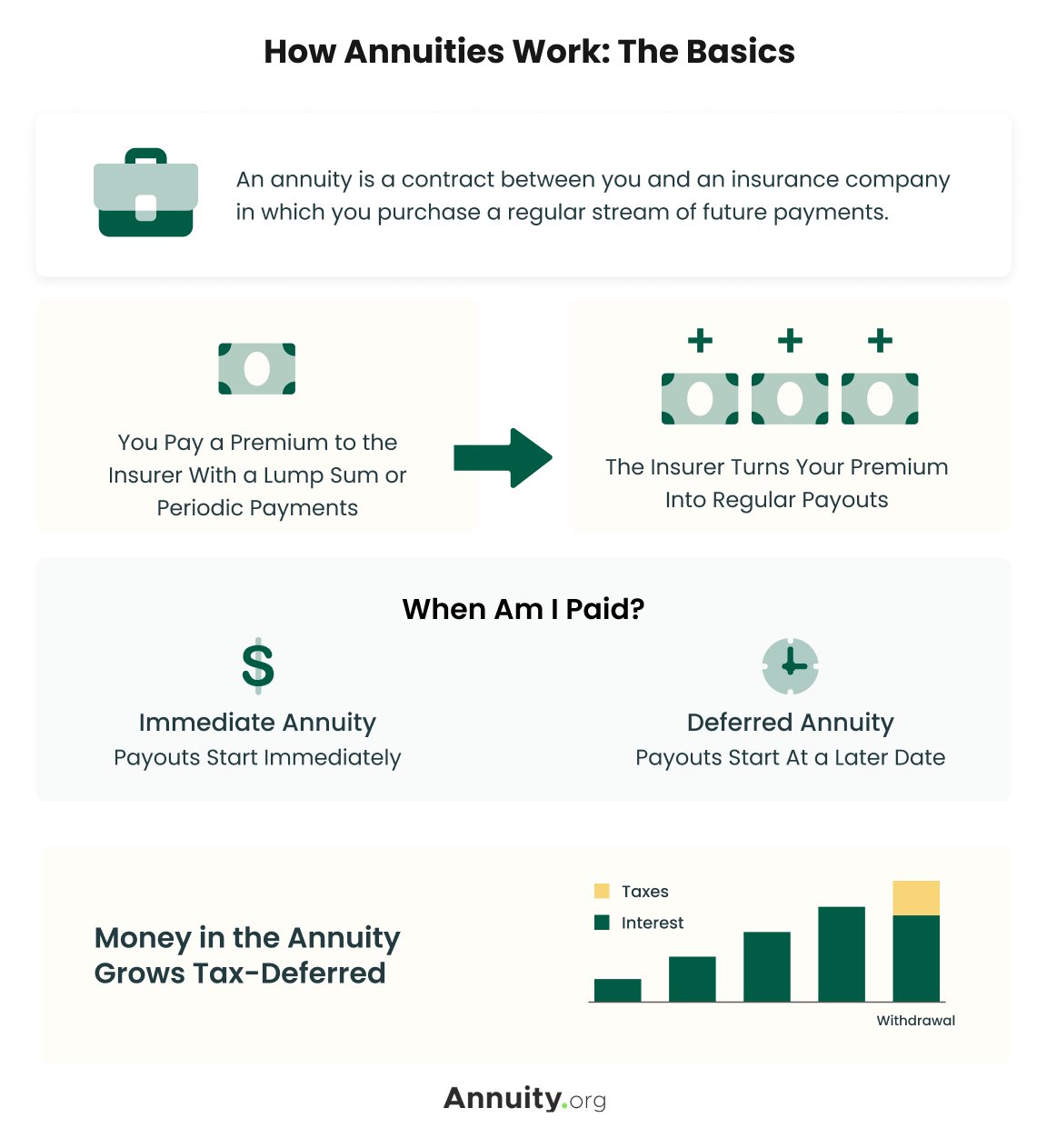

How do I receive payments from an Annuities?

Are annuities a legitimate suggestion, a shrewd move to protect surefire income for life? In the simplest terms, an annuity is an insurance coverage item (that only licensed agents might market) that ensures you month-to-month settlements.

Exactly how high is the surrender charge, and how much time does it use? This typically uses to variable annuities. The even more bikers you tack on, and the less threat you're prepared to take, the reduced the repayments you should anticipate to obtain for a given premium. After all, the insurer isn't doing this to take a loss (however, a bit like a gambling enterprise, they agree to shed on some clients, as long as they greater than offset it in greater earnings on others).

Annuity Interest Rates

Annuities chose correctly are the ideal choice for some people in some circumstances. The only means to understand for sure if that includes you is to initially have an extensive economic plan, and after that determine if any kind of annuity alternative offers enough benefits to validate the prices. These prices include the bucks you pay in costs of program, but also the chance expense of not investing those funds in different ways and, for much of us, the effect on your eventual estate.

Charles Schwab has a nifty annuity calculator that reveals you roughly what settlements you can anticipate from repaired annuities. I made use of the calculator on 5/26/2022 to see what an immediate annuity may payout for a single costs of $100,000 when the insured and partner are both 60 and reside in Maryland.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning A Comprehensive Guide to Investment Choices Defining Choosing Between Fixed Annuity And Variable Annuity Benefits of Choosing the Right Financial Plan Why Fixed

Highlighting the Key Features of Long-Term Investments A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Pros and Cons of Fixed Annuity Or Variable Annuity Wh

Exploring Variable Annuity Vs Fixed Indexed Annuity A Comprehensive Guide to Fixed Annuity Or Variable Annuity What Is the Best Retirement Option? Features of Smart Investment Choices Why Fixed Index

More

Latest Posts