Featured

Table of Contents

Trustees can be household participants, relied on people, or monetary establishments, depending on your preferences and the complexity of the count on. The objective is to make sure that the depend on is well-funded to fulfill the kid's long-term economic requirements.

The function of a in a youngster support trust can not be underrated. The trustee is the private or company in charge of taking care of the trust's possessions and ensuring that funds are distributed according to the terms of the trust contract. This includes seeing to it that funds are made use of solely for the youngster's advantage whether that's for education and learning, treatment, or day-to-day expenditures.

They should additionally supply regular reports to the court, the custodial moms and dad, or both, relying on the regards to the depend on. This responsibility makes certain that the trust fund is being managed in such a way that benefits the kid, avoiding abuse of the funds. The trustee additionally has a fiduciary obligation, meaning they are legally bound to act in the very best passion of the kid.

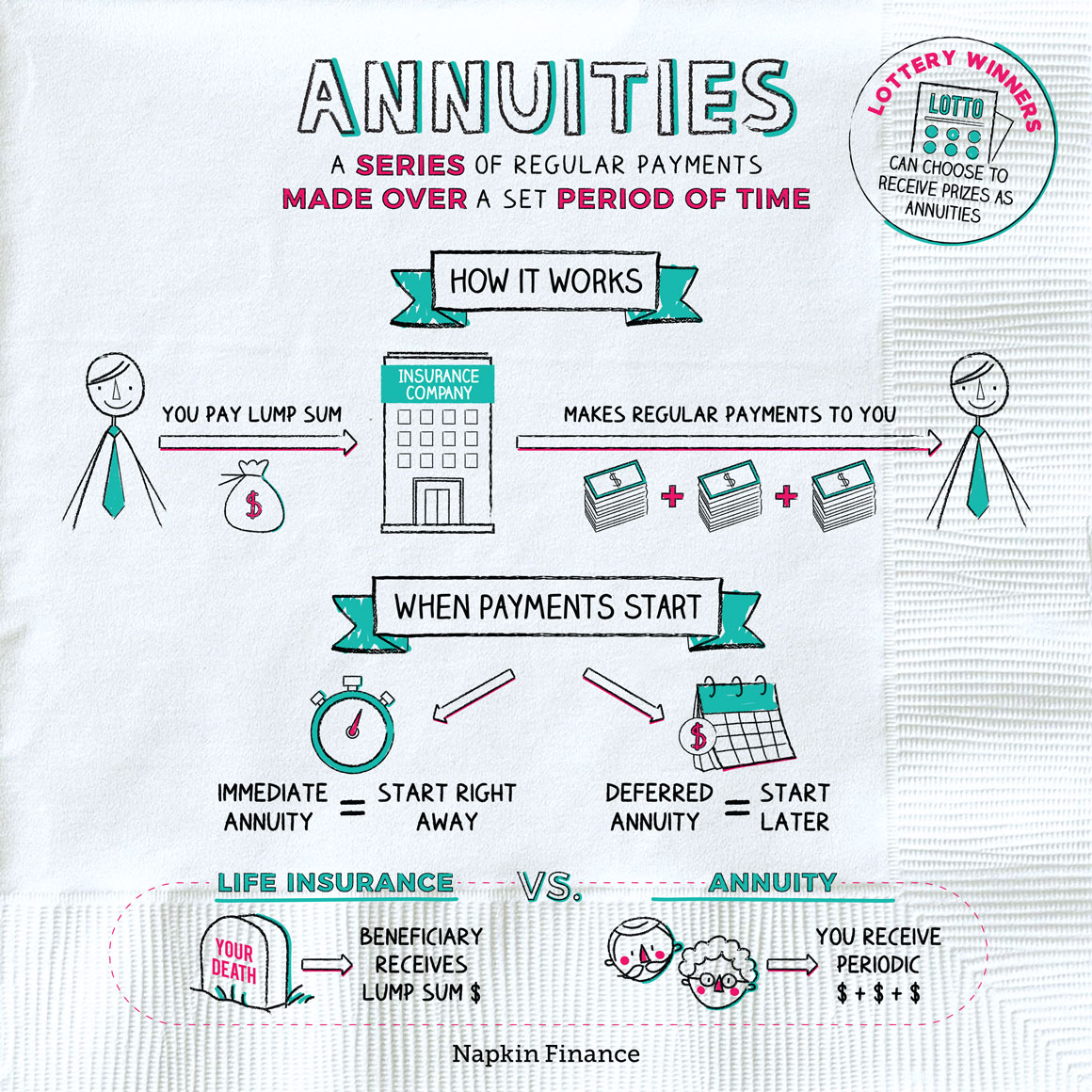

By acquiring an annuity, moms and dads can ensure that a fixed amount is paid regularly, no matter any kind of variations in their income. This provides assurance, recognizing that the youngster's requirements will certainly continue to be met, no issue the economic situations. Among the key advantages of using annuities for youngster support is that they can bypass the probate process.

What is the best way to compare Tax-deferred Annuities plans?

Annuities can likewise provide defense from market variations, ensuring that the kid's financial assistance continues to be stable even in volatile financial conditions. Annuities for Child Support: A Structured Solution When establishing, it's necessary to take into consideration the tax obligation implications for both the paying parent and the youngster. Counts on, depending upon their framework, can have different tax treatments.

While annuities provide a stable revenue stream, it's crucial to understand exactly how that revenue will certainly be exhausted. Depending on the framework of the annuity, repayments to the custodial parent or child might be thought about taxable earnings.

One of the most considerable benefits of making use of is the capacity to shield a youngster's financial future. Counts on, in certain, use a degree of security from creditors and can make sure that funds are made use of responsibly. A trust fund can be structured to make certain that funds are just made use of for particular objectives, such as education and learning or health care, avoiding misuse.

Who offers flexible Fixed Annuities policies?

No, a Texas youngster support trust is especially developed to cover the kid's vital demands, such as education and learning, medical care, and everyday living costs. The trustee is lawfully obliged to guarantee that the funds are utilized solely for the benefit of the child as detailed in the trust fund agreement. An annuity gives structured, predictable settlements in time, ensuring consistent financial support for the child.

Yes, both youngster assistance depends on and annuities come with prospective tax implications. Depend on income may be taxed, and annuity repayments can also undergo tax obligations, depending on their framework. It is necessary to seek advice from with a tax professional or monetary advisor to understand the tax obligations connected with these economic tools.

How do I apply for an Annuity Interest Rates?

Download this PDF - Sight all Publications The senior population is large, growing, and by some price quotes, hold two-thirds of the private riches in the United States. By the year 2050, the variety of elders is projected to be almost two times as huge as it remained in 2012. Considering that numerous seniors have been able to save up a nest egg for their retirement years, they are commonly targeted with fraudulence in a means that younger people without any financial savings are not.

In this environment, customers should arm themselves with info to protect their rate of interests. The Attorney general of the United States provides the complying with pointers to consider before acquiring an annuity: Annuities are complex financial investments. Some bear complicated high qualities of both insurance coverage and securities products. Annuities can be structured as variable annuities, repaired annuities, instant annuities, deferred annuities, etc.

Customers need to review and recognize the program, and the volatility of each financial investment detailed in the program. Investors should ask their broker to clarify all terms and problems in the syllabus, and ask questions about anything they do not recognize. Fixed annuity products might likewise lug risks, such as lasting deferment periods, preventing capitalists from accessing every one of their cash.

The Lawyer General has filed lawsuits versus insurance coverage companies that offered unsuitable postponed annuities with over 15 year deferral durations to investors not anticipated to live that long, or who need accessibility to their money for health treatment or helped living costs (Annuities for retirement planning). Investors ought to make certain they understand the long-lasting effects of any type of annuity acquisition

What is an Tax-deferred Annuities?

Be careful of seminars that provide complimentary dishes or gifts. Ultimately, they are rarely totally free. Be cautious of agents that provide themselves fake titles to enhance their reliability. One of the most significant cost connected with annuities is commonly the abandonment charge. This is the portion that a consumer is charged if he or she withdraws funds early.

Consumers might desire to get in touch with a tax obligation expert before purchasing an annuity. Additionally, the "safety and security" of the investment depends upon the annuity. Be cautious of representatives that aggressively market annuities as being as safe as or better than CDs. The SEC alerts customers that some sellers of annuities items urge customers to switch to another annuity, a method called "spinning." Regrettably, agents might not properly divulge costs connected with changing investments, such as brand-new abandonment charges (which usually begin again from the day the item is changed), or dramatically transformed advantages.

Agents and insurer might use bonus offers to lure investors, such as additional rate of interest points on their return. The benefits of such "bonuses" are typically outweighed by increased costs and administrative costs to the capitalist. "Rewards" might be just marketing tricks. Some unscrupulous representatives urge consumers to make impractical investments they can not pay for, or purchase a long-term deferred annuity, although they will require accessibility to their cash for healthcare or living expenditures.

This area offers information useful to senior citizens and their families. There are many occasions that may impact your advantages. Offers information often asked for by brand-new retirees consisting of transforming health and wellness and life insurance policy options, Soda pops, annuity settlements, and taxed sections of annuity. Explains exactly how benefits are affected by events such as marriage, separation, death of a spouse, re-employment in Federal service, or inability to take care of one's funds.

Where can I buy affordable Annuity Interest Rates?

Key Takeaways The recipient of an annuity is a person or organization the annuity's proprietor designates to get the agreement's survivor benefit. Various annuities pay out to recipients in different ways. Some annuities may pay the recipient stable settlements after the contract holder's death, while other annuities might pay a survivor benefit as a lump amount.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning A Comprehensive Guide to Investment Choices Defining Choosing Between Fixed Annuity And Variable Annuity Benefits of Choosing the Right Financial Plan Why Fixed

Highlighting the Key Features of Long-Term Investments A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Pros and Cons of Fixed Annuity Or Variable Annuity Wh

Exploring Variable Annuity Vs Fixed Indexed Annuity A Comprehensive Guide to Fixed Annuity Or Variable Annuity What Is the Best Retirement Option? Features of Smart Investment Choices Why Fixed Index

More

Latest Posts